- Medicare Part A Deductible 2020

- Cost Before Deductible

- Annual Deductible For Medicare 2020 Cost

- Medicare Medical Deductible 2020

People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020. Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. Medicare’s annual payment rate updates for most categories of providerservices would be reduced below the increase in providers’ input prices by the growth in economy-wide productivity (1.0 percent over the. Part B deductible—$203 per year. Medicare Advantage Plans (Part C) & Medicare Drug Plans (Part D) Premiums. Visit Medicare.gov/plan-compare to get plan premiums. You can also call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048. You can also call the plan or your State Health Insurance Assistance Program (SHIP). Changes to the 2020 Annual Deductible Medicare recipients must meet an annual deductible with Medicare Part B, which is $198 for 2020. If a Medicare enrollee was eligible for a Medigap plan that pays for the Part B deductible prior to 2020, they can still receive that benefit.

A “first-dollar coverage Medicare plan” refers to a Medicare Supplement Insurance (Medigap) plan that doesn’t require you to first satisfy a deductible before your coverage kicks in.

In other words, your plan coverage takes effect with the “first dollar” you spend on covered care.

Medicare Part A and Part B each require a deductible. Several Medicare Supplement Insurance (Medigap) plans provide first-dollar coverage for Medicare Part A, meaning that you don’t have to pay any Part A deductible costs.

Beginning in 2020, however, the two Medigap plans that cover the Part B deductible (Plan F and Plan C) will no longer be available to newly eligible Medicare beneficiaries.

What happened to First-Dollar Coverage Medicare Plans F and C in 2020?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap first-dollar coverage of the Part B deductible will be restricted to beneficiaries who became eligible for Medicare prior to January 1, 2020.

Anyone who becomes eligible for Medicare on or after Jan. 1, 2020, will not be allowed to enroll in either Medigap Plan F or Plan C, both of which provide first-dollar coverage of Medicare Part B services.

If you are already enrolled in Plan F or Plan C prior to January 1, 2020, you will be allowed to keep your Medigap plan.

If you are eligible for Medicare before Jan. 1, 2020, you can still be able to enroll in either Plan F or Plan C if they are available where you live.

Plan F and Plan C are both popular Medigap plans. In 2017, 55% of all Medigap beneficiaries were enrolled in Plan F, while 6% of all Medigap beneficiaries were enrolled in Plan C.1

In 2021, the Medicare Part B deductible is $203 per year.

Is Medicare Plan G Now Better Than Plan F?

Plan F is the only Medicare Supplement plan that covers all nine of the benefit areas covered by standardized Medicare Supplement plans.

Staring in 2020, the Medigap plan that covers the most benefits for newly-eligible Medicare beneficiaries will be Medicare Plan G, which covers all possible Medigap benefits except the Part B deductible.

Medigap Plan G is increasingly popular. In 2017, 13% of all Medigap beneficiaries were enrolled in Plan G. This was 31% increase from the previous year, which was by far the sharpest enrollment increase of any Medigap plan.1

Why Is Medicare Plan F Being Discontinued for New Medicare beneficiaries?

The idea behind the MACRA legislation was to force Medicare Part B beneficiaries to maintain some “skin in the game.” That is, the belief is that Medicare beneficiaries may be more invested in their outpatient medical care if they aren’t able to visit the doctor without paying out-of-pocket costs.

Proponents of the rule say that people will think twice about visiting the doctor for every little pain or sniffle, because they will have to pay at least some costs out of pocket for the appointment. The intended result would be less-crowded waiting rooms and lower overall health care costs.

Critics argue that eliminating first-dollar coverage might cause some people to forego care, resulting in more expensive care (or more serious health effects) later on.

Which Medigap Plans Offer First-Dollar Coverage of Medicare Part A?

If you become eligible for Medicare on or after January 1, 2020, you will be able to apply for one of seven Medigap plans that provide coverage of the Part A deductible (depending on your local plan selection).

Four Medigap plans — Plan B, Plan D, Plan G and Plan N — cover the Part A deductible in full.

Two plans — Plan K and Plan M — provide 50% coverage of the Part A deductible. And Plan L provides 75 percent coverage.

Those who were eligible for Medicare prior to Jan. 1, 2020, can also apply for a plan that offers first-dollar coverage of Part A with Medigap Plan C and Plan F, which both provide 100 percent coverage of the Part A deductible.

The chart below shows the benefits that are offered by each of the 10 standardized 2019 Medigap plans available in most states.

Click here to view enlarged chartScroll to the right to continue reading the chart

Medicare Supplement Benefits

Part A coinsurance and hospital coverage

Part B coinsurance or copayment

Part A hospice care coinsurance or copayment

First 3 pints of blood

Skilled nursing facility coinsurance

Part A deductible

Part B deductible

Part B excess charges

Medicare Part A Deductible 2020

Foreign travel emergency

| A | B | C* | D | F1* | G1 | K2 | L3 | M | N4 |

|---|---|---|---|---|---|---|---|---|---|

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | 50% | |||||||

| 80% | 80% | 80% | 80% | 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

+ Read more1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission.

- Read lessHow Much Does the Medicare Part A Deductible Cost?

While some health insurance deductibles operate on an annual basis, the Medicare Part A deductible is not an annual deductible.

The Part A deductible is based on a “benefit period.”

A benefit period begins the day you are admitted to the hospital as an inpatient.

A Part A benefit period ends once you have not been an inpatient for at least 60 consecutive days.

It’s possible for a Medicare beneficiary to accrue more than one benefit period within the same calendar year. In this case, you have to pay the full Part A deductible for each benefit period.

In 2021, the Part A deductible is $1,484 for each benefit period.

How Can I Find First-Dollar Medicare Supplement Plans?

If you became eligible for Medicare before Jan. 1, 2020, you may still be able to apply for a Medigap plan that provides first-dollar coverage for Medicare Part B, if one is available where you live.

If you don’t become eligible for Medicare until after that date, you may be able to apply for first-dollar Medicare Supplement coverage of Medicare Part A, if one of these Medigap plans is available in your area.

Call today to speak with a licensed insurance agent who can help you compare Medigap plans in your area to find a plan that works for your coverage needs.

Find Medicare Supplement plans in your area.

Compare Plans1 AHIP. State of Medigap 2019. (May, 2019). Retrieved from www.ahip.org/wp-content/uploads/IB_StateofMedigap2019.pdf.

Christian Worstell is a health care and policy writer for MedicareSupplement.com. He has written hundreds of articles helping people better understand their Medicare coverage options.

Resource Center

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance.

By clicking 'Sign up now' you are agreeing to receive emails from MedicareSupplement.com.

We've been helping people find their perfect Medicare plan for over 10 years.

Ready to find your plan?

Last Updated : 04/16/20204 min read

Summary: The Centers for Medicare and Medicaid Services (CMS) sets the maximum Medicare Part D deductible each year. In 2020, the maximum Part D deductible is $435, but depending on where you live, you may find a plan with a lower deductible or even no deductible at all.

Find affordable Medicare plans in your area

Medicare Part D coverage for prescription drugs is technically optional, but if you enroll in Original Medicare (Part A and Part B), there is very little coverage for prescription medications you take at home. For that reason, most Medicare enrollees choose to buy a Medicare Part D plan to help pay for prescription drugs.

Medicare Part D plans are private insurance plans. Insurance companies are free to design plan benefits and cost-sharing structures to meet the needs of their members, as long as they follow Medicare’s rules for minimum coverage requirements. Your costs and benefits may be different with each plan available in your area. Here’s a breakdown of the costs you can expect with Medicare Part D.

What are my costs with Medicare Part D?

Private Medicare Part D prescription drug plans generally include some combination of the following costs:

- Medicare Part D premiums

- Annual Medicare Part D deductible

- Copayments (flat fee per prescription)

- Coinsurance (a percentage of actual medication costs)

What is the Medicare Part D deductible for 2020?

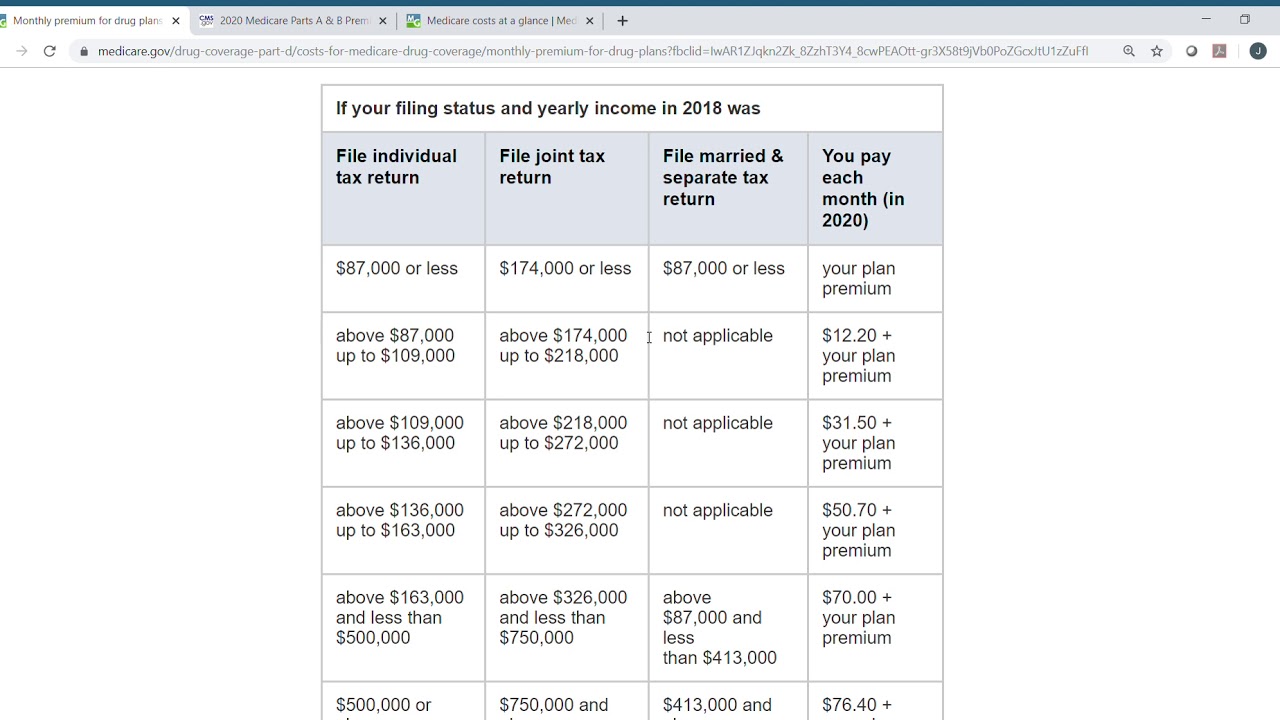

A Medicare Part D deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to pay its share of your medications that are covered. This is for a calendar year and resets every January 1. The 2020 maximum deductible set by CMS is $435, however, insurers can set their deductible below the limit. According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible. Of those, 69% use the $435 maximum established by CMS. If you get your Medicare Part D coverage through a Medicare Advantage plan, you may not pay a deductible.

Once you reach your Medicare Part D deductible, your plan pays its share of your medications. Most plans use a tiered copayment system. Generic medications are in the lower tiers and generally have a copayment of between $0 and $10 each. Expensive brand-name and specialty medications may have a higher copayment or coinsurance amount.

Cost Before Deductible

What is the Medicare Part D coverage gap?

Your costs during the deductible phase of your Medicare Part D coverage, as well as your costs and the insurance company’s costs during the initial coverage phase, are added together to determine whether you will move into the coverage gap and catastrophic coverage phase.

In 2020, you enter the coverage gap once you and your insurance company spend $4,020 on prescription drugs in a year. In the coverage gap, you no longer pay your tiered copayment when you buy prescription drugs. You pay up to 25% of the cost of your medications until total prescription drug spending reaches $6,350 in 2020. In the catastrophic phase, you pay a small copayment or coinsurance amount of no more than 5% of the cost of your covered medications or $8.95, whichever is greater, for the rest of the year.

How do I compare Medicare Part D Prescription Drug Plans?

Annual Deductible For Medicare 2020 Cost

You should look at all three out-of-pocket expenses when you compare plans: Your Medicare Part D premiums, deductible, and copayment or coinsurance amounts. A plan with a higher deductible may have lower monthly premiums. If you don’t use a lot of prescription medications, that may be the most cost-effective option for you. On the other hand, if you take daily medications, a lower deductible may be more important so you get help with your medications with less out-of-pocket expense.

If you take daily medications, it’s very important to look at each plan’s formulary. A formulary is simply the list of covered medications and your costs for each. Check to make sure the plans covers all your daily medications. Also remember a Medicare Supplement Insurance Plan doesn’t cover any costs associated with Medicare Part D coverage.

Finally, compare pharmacy networks and benefits such as mail-order pharmacies. If you have a preferred pharmacy and it’s not in a plan’s network, you may be happier with a different plan. With many plans, you can save on your copayments and out-of-pocket costs by using the plan’s mail order pharmacy for medications you take regularly. If a plan offers this option, you may actually come out ahead even if the plan has a higher deductible or monthly premium, depending on the medications you use.

Medicare Medical Deductible 2020

Limitations, copayments, and restrictions may apply. Premiums and/or copayments/co-insurance may change on January 1 of each year.